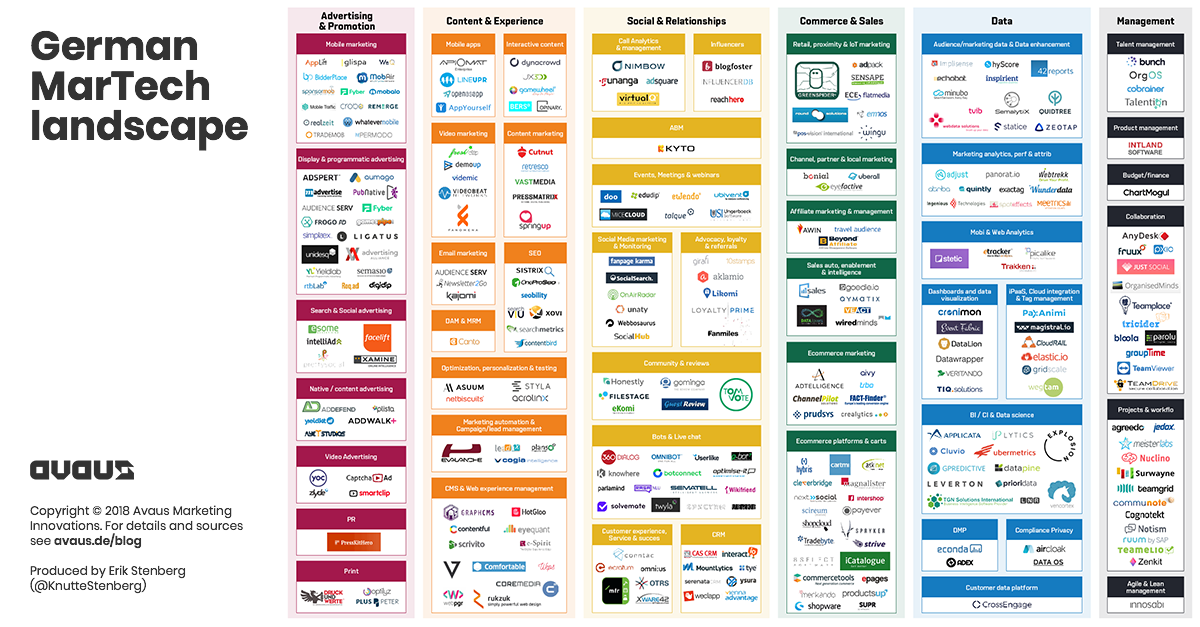

Inspired by none other than Scott Brinker’s behemoth Marketing Technology Landscape Supergraphic: Martech 5000, a painstakingly detailed overview of the world’s marketing technology providers – and following on from their Finnish Marketing Technology Landscape edition, Finnish agency Avaus Marketing Innovations have given us cause to hover the magnifying glass over Germany’s own marketing technology landscape.

Have a geez;

Credit: Avaus

Speaking from the experience of pulling together the UK version – this undertaking can be a real bitch. So we tip our hat to our Nordic neighbours who have dashed out a ~second~ analysis like it’s NBD and further proving that martech truly is Olympic in nature.

Inspired by their own recent operations growth in the German market, the Nordic agency uncovered an impressive 296 vendors across six core categories; Advertising & Promotion, Content & Experience, Social & Relationship, Commerce & Sales, Data and, Management.

See also: Marketing Technology Landscape 2020

This latest iteration follows on from the Finnish version, Canadian, Chinese, a Blockchain specific version and of course our very own UK version.

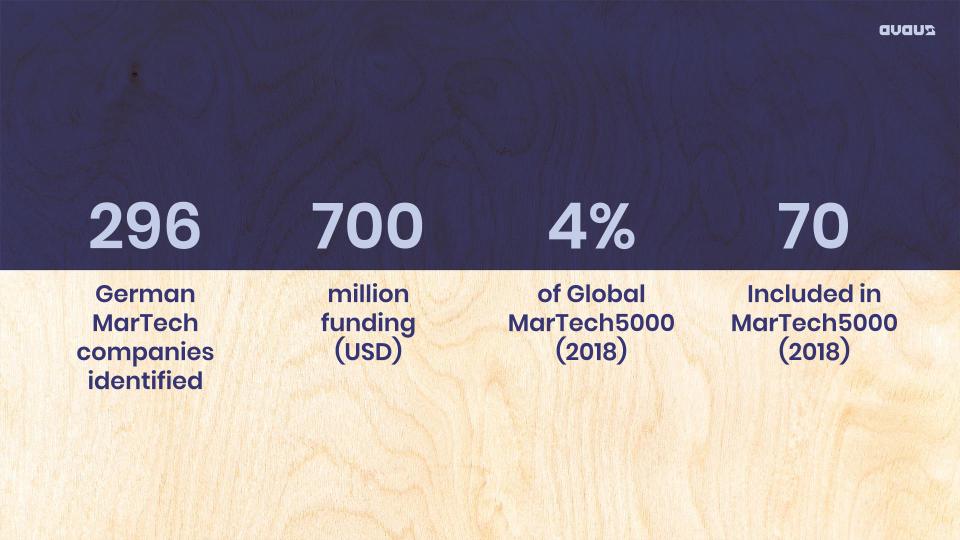

So what are the top-line digits?

- 296 German vendors were uncovered

- Vendors sit across 6 core categories and 48 sub-categories

- Only 23% of the German vendors were represented In Scott Brinker’s latest version

- 88 of the German vendors have received external funding to the tune of $700 m USD

- Over 80% of the companies were founded in the last 10 years

- And 28% in just the last 3 years

- Berlin takes the cake with 118 of the vendors based in the capital

MUST READ: UK Marketing Technology Supergraphic

Credit: Avaus

Speaking with the man who spearheaded the analysis at Avaus Marketing Innovations, Erik Stenberg Senior Consultant & Head of B2B DACH had this to say about the German martech landscape;

Germany is the powerhouse of the eurozone, and as such it concentrates a lot of capital and competences. That, together with strict local privacy norms and the extension of Austria and Switzerland forming the germanophone DACH-area, is fertile ground for specialised players in the digital economy.

Most of the growth lately comes from the subcategory of Social & Relationships. As social media adoption growth tapers off, so it seems has the expansion rate of the German MarTech landscape. Now we are eagerly anticipating what will happen in the sectors of Advertising & Promotion as well as Data where the investors are funneling their money.

What have we learned? According to Avaus the key insights we can take away from the German analysis are...

New Kids on the Block

28% of the companies (for which a founding date is confirmed) were founded in just the last 3 years. Almost all of them within the last decade…it’s certainly a young market and as is common with start-ups, the number of employees correlates directly with the age of the company with 32% having fewer than 10.

Adtech and data FTW

While funding in the martech space has been modest (700m euros to date across 88 of the 290 companies) it’s Adtech and Promotion where the biggest sums have been allocated, with Data seeing smaller funding across more companies.

The Silicon Valley shift

The changing attitudes towards Silicon Valley, its cost of living, bad traffic and money obsessed toxic culture are seeing record numbers of outward migration from the area giving rise to start ups looking elsewhere to set up base.

The Berlin boom

Perhaps unsurprisingly, it’s the nation’s capital which is undoubtably the epicentre for marketing and technology start-ups. Berlin’s lifestyle, cheap rent and plentiful co-working spaces attract a diverse mix of entrepreneurs.

If like us you await the release of Marketing Technology Landscape Supergraphics with equal parts trepidation and giddy excitement…maybe you’ll want to join us at this year’s #MarTechFest where we’ll nerd out with Scott Brinker and deep dive the insights.