Partner Content

Most brands approached the pandemic in the same way; they rushed to increase their online presence. With the necessity of no-contact customer engagement and experience, any digital transformation was accelerated ten-fold.

Many industries had to rush to accommodate these changes. However, the retail and eCommerce space were ready.

The industry had been adapting to the digital world over a long period of time, in order to provide a more complete and extensive customer experience and service, so it was no surprise that 76% of brands had been using email as a channel for 6+ years prior.

Although, this does not mean the retail space was untouched by the pandemic; the advantages gained were undercut by highly disruptive supply chain issues, which still continue.

The increase in eCommerce demand, despite this technological support, has caused brands to rethink supply chain efficiencies due to this unprecedented boom.

Issues such as warehouse, labour, and stockpile shortages add to this difficulty, meaning innovative customer engagement strategies are vital. So, with 73% of sales taking place online, accounting for 51% of industry revenue, brands must have a clear and meaningful approach in this area.

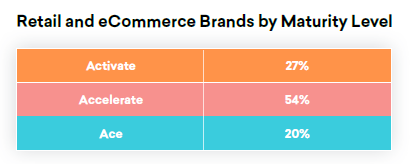

So, in order to determine how mature brands are in this area, Braze applied their Customer Engagement Index to brands within the retail and eCommerce space.

Braze is able to determine whether a brand falls into one of three categories. These are:

- Activate. A company in this category is just beginning to recognise the importance of customer engagement. If they only focus on campaign- and channel-specific solutions, they remain in this category.

- Accelerate. This category differentiates itself through a brand having a strong experimentation culture, and robust metrics. Though, they will still be lacking a comprehensive view of customers across platforms and channels.

- Ace. The top tier. Customer engagement is lifecycle-centric, owned by cross-functional teams, and built on streaming data.

So, what were the results?

So, while brands in this industry have some of the highest scores in the Customer Engagement Index, Braze had anticipated even stronger Ace representation than the results are offering. This is due, in part, to the vertical's early adoption of a digital approach.

Braze, however, offer a solution. Companies in the industry should focus their attention on two competencies; teams and tech. By improving these, they will be able to access the benefits Ace companies see.

Ace gain tangible results; brands in this category have a 38% increase in repeat buyer conversion rate, as well as a 8.6x increase in purchases per user. So, in order to achieve similar results, brands must consider their techniques and behaviours in this area.

Let's start with improving team structure and strategies.

Embracing Teams, and Teamwork

In order to move to the Ace category, Braze encourage brands to embrace teamwork to address strategy challenges.

By focusing on experimentation, strategy, and staffing, brands will be able to expand their reach, and build better relationships with customers. Experimentation is seen commonly in Ace teams, with these companies being 97% more likely to actively experiment with their campaigns and customer journeys.

Plus, concentrating on these three competencies will help address the upcoming strategies associated with the death of third-party cookies, and adapt to a new data landscape. But remember: it's vital your employees are well-trained and well-informed. Ace brands are 42% more likely to have employees trained on customer engagement tech and approaches.

Leaning into Tech

Data, orchestration, and channels are the three tech competencies Braze encourage brands to consider, in order to move into the Ace category, and gain the benefits seen by the top-performing brands.

Improving on their technical capabilities will allow brands to operationalise zero- and first-party data use, in relation to orchestration and messaging channels. This will mean customers will receive the personalised and relevant messaging they desire, without the reduction in trust third-party data causes.

In fact, due to the effectiveness of zero- and first-party data as a customer experience and engagement approach, 35% of companies say they will begin to allocate an increase budget to focus on the space.

Plus, top-performing companies are more likely to continuously export user behaviour and engagement data for analysis, showing a dynamic and enterprising approach to data beyond collection and basic use.

On top of this, Ace brands are 48% more likely to individually personalise messages at send time, providing the personalisation customers require.

So, Ace brands tend to have a distinct and pro-active approach to technology. In fact, they are 18% more likely to use a single solution to orchestrate cross-channel campaigns.

Using tech and teams, brands must seek to continually improve and update their customer engagement strategy. However, the issues that have emerged from the pandemic shows that brands cannot rely on the advantages gained from pre-emptive technological advances.

So, brands must build on their success to date, in order to remain relevant and competitive.

Check out Braze's Global Customer Engagement Review in full, here.