As of January 2021, approximately $20.5 billion was invested in De-Fi. So, what is this term you've heard your 15-year-old nephew chatting about with his friends on Discord? Also what's a TikTok? Who is N. F. Tee? What's a Billy Eyelash? Let's find out.

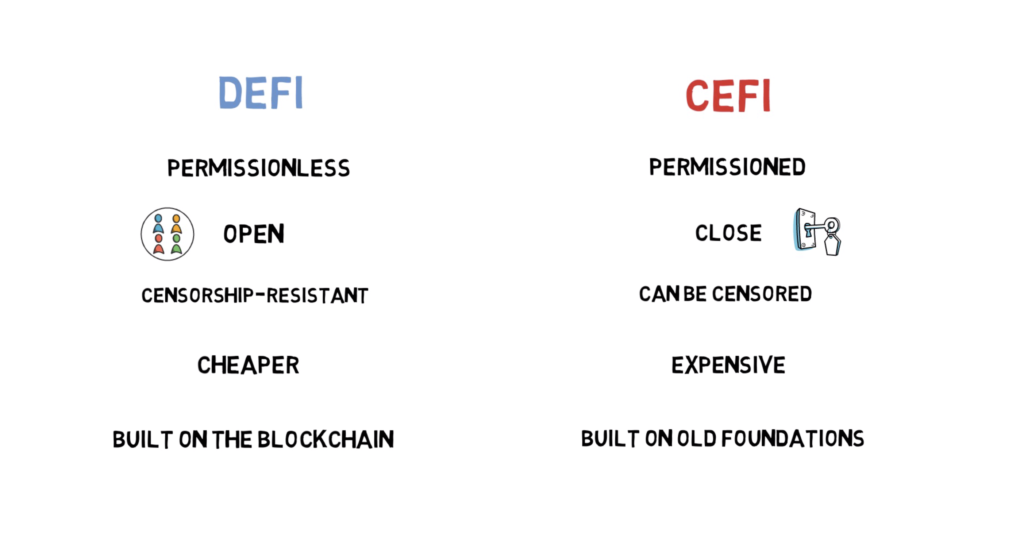

De-Fi is short for decentralised finance. Right, we're one step closer to uncovering the puzzle. So, basically, it's an umbrella term for a bunch of financial applications in crypto or blockchain, meant to disrupt traditionally relied upon intermediaries. Think about it as cutting out the suited, banker, slicked-back-hair, middle man.

The most important part is this: de-fi, stripped back, is a financial service which utilises a smart contract. This is an enforceable, automated agreement that has no need for a mediator or intermediary, like your bankers or your lawyers. Instead, it uses blockchain technology.

De-fi often relies on blockchain, the tech that facilitates cryptocurrencies. Blockchain allows several entities to hold a copy of the history of past transactions, so it's not overseen by a single source.

Proponents of the tech stress the importance of this, as human overseers can limit the speed and sophistication of transactions, while this system returns the control directly back to the people to whom the money belongs.

Plus, De-Fi expands the use of blockchain from just simple transfers, and opens it up to being used in more complex financial use cases.

Many people expect the De-Fi market to grow in 2021, thanks to the unprecedented boom of De-Fi crypto in 2020, which surged to over 400% since last year.

What does this mean for businesses, and specifically marketers?

Well, decentralised finance is emerging as a tool for smaller businesses in developing markets, especially remittances and small loans. It overhauls the inflexibility of present processes, which can have a number of different benefits. In fact, an uptake in De-Fi in transaction banking could offer new capital opportunities for larger companies, and increase liquidity for SMEs.

Smaller businesses in developing markets have taken to De-Fi as their needs have often been unmet by the traditional banking system.

According to Samantha Pelosi, SVP of Payments and Innovation at BAFT, the largest trade association for transaction banking:

“The potential efficiency gains and democratization of finance associated with DeFi are attractive to traditional financial institutions. However, DeFi negates the need for relationships with trusted intermediaries, which makes the model disruptive and somewhat alien to these banks.”

How does De-Fi benefit businesses and marketers?

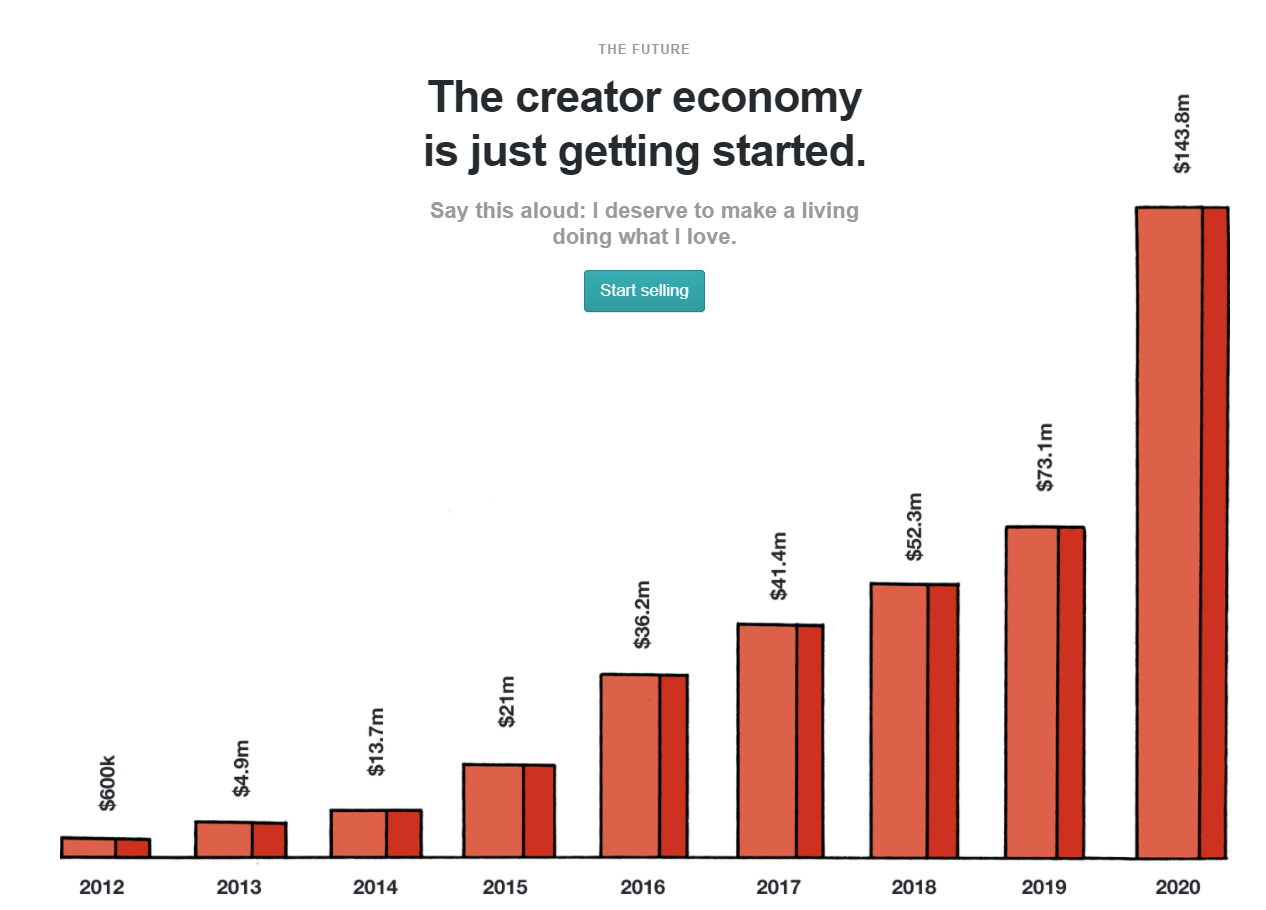

1. The Creator Economy

The creator economy refers to the monetisation of work made by independent creators.

From vloggers, to streamers, to influencers, to YouTube dog chefs, the creator economy implies a shift in the dynamics of power in entertainment. This also encompasses the companies supporting these creators, from brand deals to creation tools and analytics platforms.

Anyone who makes, or benefits from, independent content creation is affected by the creator economy.

The creator economy is becoming increasingly data- and tech-driven, especially with the shift in entertainment influence, the need to innovate and compete is vital.

The creator economy appears to give creators more agency. Rather than constantly trying to keep up with changing algorithms, or brands, they can rely on income from loyal supporters. This means deciding how, and when, they take on work. And the income goes straight to them.

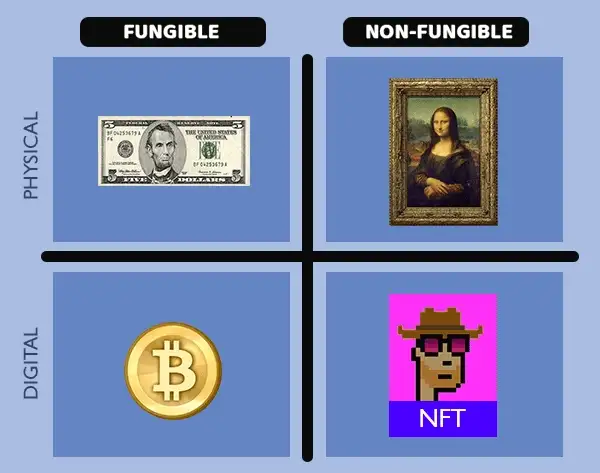

Something that has appeared as a feature of the creator economy is the use of tokenisation or NFTs to generate income. Creators are looking for ways of using NFTs to share paid experiences, in order to engage with their fans. Just like owning a piece of real merch, NFTs put a prime on ownership. So, creators can tokenise their content or art in order to 'cut out the middle man', and earn an income.

Podminers is a podcast and live streaming platform which plans to use blockchain to address issues such as fake analytics, ad fraud and fake reviews. Smart contracts let creators earn its internal token for their content, with payments coming from consumers. Content consumption is recorded on a ledger, so only these individuals can leave reviews. Fake reviews can be disruptive at best, damaging at worst.

"Fake reviews also damage the credibility of reviews, and negatively affect review helpfulness," says the Journal of Business Research.

"In addition, fake reviews seriously affect the development of online product reviews and stakeholders’ commitment to the reduction of information asymmetry between merchants and customers. "

2. Early Adoption of Blockchain

Blockchain is one of the most innovative and disruptive technologies for a long while. So, adopting this tech at an early stage will put businesses in a position to be one step ahead of the competition.

Blockchain tech can automate processes, remove intermediaries, cut costs, and ensure transparency and security. Now, we all know trust is king with customers. So, if you can guarantee safety and clarity, you can build a long-term relationship with your clients. This tech also reduces human errors, and improves user experience.

Blockchain integration for internal processes can be tricky and resource intensive, so De-Fi can be a good way for businesses to experience the tech first-hand.

3. Control of Data Ownership

Talking of trust, let's switch to data.

Everyone knows that centralised intermediaries, like Google and Facebook collect and store a bunch of data, monetising huge amounts of personal data. All with very little (i.e. no) transparency. Where's the data being collected? Where's it being stored? Who's it being sold to? It's no wonder 42.6% of US residents distrust Facebook.

With decentralised alternatives this kind of nonsense can't happen. The data never leaves people's devices and the individual owners have sovereignty and security to choose what personal data they provide companies. This will lead to the shift to zero-party and first-party data, meaning less data provided, but in the end it'll lead to the collection of higher quality data.

So, how do you get started?

- Buy crypto from a fiat-to-crypto exchange. Using fiat money eg Dollars, Pounds, Euros, you can buy crypto. Popular exchanges include Binance and Coinbase.

- Create a software wallet to store your cryptocurrency. The most popular types of wallets tend to be hot wallets or cold wallets. Hot refers to software wallets that can be created in minutes, and are connected to the internet. Cold wallets are not connected to the internet.

- Transfer your crypto from the exchange, into your wallet. Make sure you're sending your currency between compatible blockchains. This could be Ethereum into an Ether wallet address. Remember to keep a little bit available for fees.

- Transfer your cryptocurrency from your wallet into a bank. In order to earn interest, you can transfer your currency into a bank. Each of these banks differ in terms of interest and security, so make sure you pick one right for you.